Boycott Smarter, Not Harder: Lessons from 2025’s Wins and Fails

**By Amy Lee

Money talks. That’s why one of the best ways for the average person to express dissatisfaction with a company’s policies and practices in a way that makes corporate leaders stand up and take notice is to participate in a boycott. It’s an action that is typically relatively easy, cost-free, and impactful.

But a boycott isn’t always effective. Some companies will be more impacted by a consumer boycott than others because of how they make money. If we want to maximize our impact, we need to be strategic about how we spend our time as well as our money. Here are a few companies that can be materially impacted by consumer boycotts, and a few examples of companies that won’t even notice.

Three Highly Effective Boycotts

Target

Target bet big on being a one-stop retail destination, from fresh produce to meats, attracting shoppers who value style and experience. It once proudly championed DEI initiatives, including its annual Pride collection.

Then the Trump administration pressured corporations to abandon DEI. Target complied—and the backlash was swift.

The boycott went viral. Activist groups mobilized, hashtags like #TargetFast flooded social media, and news outlets amplified the outrage. With sustained coverage and repeated consumer action, Target learned the hard way: abandoning your values comes at a steep cost.

Timeline

★ Jan 2025 – Target announced that it is ending its DEI (Diversity, Equity, Inclusion) initiatives, discontinuing external benchmarking programs such as the HRC Corporate Equality Index, and rebranding its Supplier Diversity program. Later in the month, shareholders filed a class-action lawsuit, alleging that Target misled investors about the financial risks of scaling back its DEI efforts.

★ February - March 2025: Target admits that it experienced a 9.5% drop in foot traffic in February and a 7.9% drop in March. The company’s market value plunged by approximately $12.4 billion.

★ April 2025: Target's stock hit a five-year low.

★ May 2025: Target reports Q1 2025 results: Net sales: $23.8B, down from $24.5B in Q1 2024. Comparable same-store sales down 3.8%

★ August 2025: The CEO was replaced by the COO. The company’s stock falls by 6%. Target admits that quarterly same-store sales slumped 1.9%

★ September 2025: By mid-September, Target's stock had plummeted 33%, wiping out over $20 billion in shareholder value, according to Investopedia.

Why was this boycott effective?

Target has a single revenue stream: retail. While online sales are important, in-store foot traffic drives the business. Online shoppers make fewer impulse purchases, but browsing customers can easily be lured by attractively displayed merchandise—who hasn’t grabbed an extra box of donuts just because it looked good? A sustained drop in patronage is lethal. Target bet that siding with Trump’s white nationalist policies would pay off—but it ended up costing them big time.

Tesla

Elon Musk is Tesla’s face—and he’s taken the company on a hard political right turn. After funding much of Trump’s campaign, Musk was tapped to lead DOGE, a shadow federal agency, deploying unqualified digital shock troops to shutter institutions and push out 300,000 federal employees.

The backlash was immediate. Protesters swarmed Tesla dealerships nationwide, challenging Musk, DOGE, and the Christofascist Trump regime. The boycott has hit Tesla hard: sales have declined, stock value has dropped, and the used-vehicle market is crumbling as consumers pull back amid vandalism and unrest.

Timeline:

★ January 2025: DOGE is launched

★ February 2025: Protesters begin to organize under the Tesla Takedown umbrella, holding actions at Tesla dealerships around the world.

★ March 2025: Tesla Takedown organized a global day of action, with protests at 277 Tesla dealerships worldwide

★ April 2025: Tesla reports Q1 2025 global deliveries fell 13% YoY. The company’s stock plunged by an estimated 45%

★ May 2025: As pressure from protesters and shareholders alike increases, Elon Musk announced his resignation from DOGE, citing disagreements over fiscal policies.

★ April - June: Q2 2025 sales continue to fall ~13% YoY

★ June 2025: Tesla admits that its 2025 sales are in freefall, dropping 13% YoY. Tesla has lost nearly $380 billion in market value

★ July 2025: Tesla shares were down 24% year-to-date, making it the worst performer among large tech companies.

★ September 2025: Tesla used-car values hit rock bottom, with Model X and S dropping over 15% in a year—more than twice the average used-car decline. The Cybertruck fared worst, reselling at 58% below its original price.

Why was this boycott effective?

Tesla’s revenue depends heavily on high-value, discretionary vehicle sales, making it sensitive to shifts in consumer sentiment. Musk’s personal visibility made the corporate brand a lightning rod, magnifying reputational and financial impact. S

Social media campaigns, protests, and repeated media coverage ensured the boycott stayed in public attention. The Tesla boycott succeeded because it combined a clear ethical rationale, high visibility, financial vulnerability, ease of consumer action, and reputational leverage, all sustained over time.

The Tesla boycott didn’t just hurt Tesla—it personally pressured Musk through a mix of market losses, public outrage, and political risk, directly contributing to his exit from the federal spotlight.

Disney

Disney (through ABC and Hulu) pulled Jimmy Kimmel Live! off the air after a monologue referencing the Charlie Kirk shooting. Kimmel’s remarks were not defamatory, yet the Trump administration seized the moment to target media it dislikes. Bowing to threats from the FCC chair, Disney suspended the show—sparking immediate and powerful consumer backlash over the blatant attack on free speech.

Timeline:

★ September 15, 2025: Kimmel comments about the reaction to the assassination of conservative activist Charlie Kirk, implicating “MAGA land” in attempts to politicize it.during his late-night show,

★ September 16: FCC Chairman Brendan Carr, appointed by Trump, condemned Kimmel’s remarks and implied the FCC could hold ABC/Disney accountable

★ September 17: Jimmy Kimmel Live! is taken off the air “indefinitely” by ABC / Disney following the regime’s pressure and criticism of Kimmel’s comments

★ September 18 - 20: An estimated 500,000 Disney accounts were cancelled by angry consumers, with experts estimating losses between $1.5 billion and $4 billion.Disney's market value declined by approximately $3.87 billion.

★ September 22: Disney announces that Late Night with Jimmy Kimmel will be returning to the air immediately, although some of its ABC affiliates, owned by Sinclair and Nexstar, initially refuse to air the show despite Disney’s reinstatement.

★ September 26: Sinclair and Nexstar agree to resume airing Kimmel across their stations.

Why was this boycott effective?

Disney is an unusual company—it places supreme value on its brand reputation. That “Disney Magic” keeps audiences coming to theaters and parks, and long-term gains and high consumer sentiment are the bedrock of its marketing strategy.

Disney rarely missteps because it avoids snap decisions. But when a few executives in its TV division decided to bend the knee, the backlash hit like a Category 5 hurricane. Other divisions, like Disney Parks and licensing, allegedly hadn’t been consulted before the axe fell. By the time Disney scrambled to backpedal, its reputation was already tarnished.

Don’t waste your time boycotting these two companies

Amazon

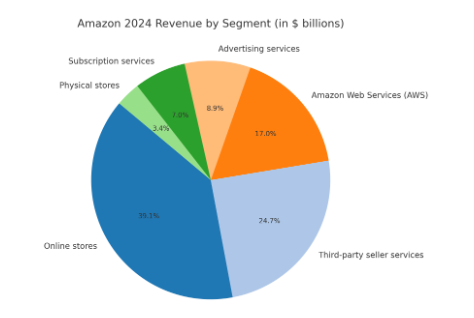

Boycotts against Amazon are generally ineffective because the company's revenue comes from a diverse portfolio of business segments. While its online stores remain the largest source of sales, Amazon Web Services (AWS) is its most profitable and fastest-growing division. Most major companies and the U.S. government are heavily invested in AWS.

Here’s how Amazon’s revenue breaks down:

● Online stores ($247.0 billion): This is Amazon's largest revenue stream, accounting for nearly 39% of total revenue. It includes sales of products sold directly by Amazon on its platform.

● Third-party seller services ($156.1 billion): This segment represents the second-largest portion of revenue at about 24.5%. It includes commissions, fulfillment and shipping fees, and other services Amazon charges to independent sellers who use its marketplace.

● Amazon Web Services (AWS) ($107.6 billion): Amazon's cloud computing business is its most profitable segment. It contributed almost 17% of total revenue in 2024 but provides over half of the company's operating income.

● Advertising services ($56.2 billion): This segment, which includes revenue from selling advertisements on Amazon's websites and elsewhere, is a fast-growing business for the company.

● Subscription services ($44.4 billion): This includes revenue from Amazon Prime memberships, Audible, and other subscription-based offerings.

● Physical stores ($21.2 billion): This category includes revenue from its brick-and-mortar outlets like Whole Foods Market.

Nestlé

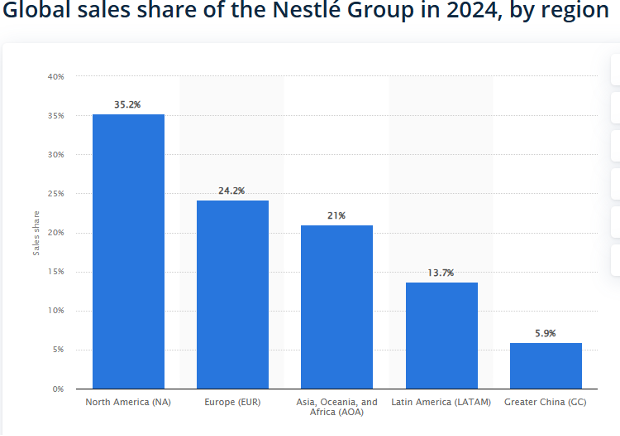

A boycott against Nestlé faces some of the same challenges as a boycott against Amazon.. Nestlé’s size, global reach, and diversified portfolio allow it to absorb most consumer boycotts with minimal financial impact. Nestlé products are ubiquitous: bottled water, baby formula, snacks, coffee, frozen foods, and more. As you can see in this detailed breakdown, Nestlé is making money everywhere.

Nestlé's 2024 sales by product category in USD

- Powdered and Liquid Beverages: $30.8B

- PetCare: $23.7B

- Nutrition and Health Science: $18.9B

- Milk Products and Ice Cream: $13.0B

- Prepared Dishes and Cooking Aids: $13.4B

- Confectionery: $10.6B

- Water: $4.0B

Nestlé Regional Revenue 2024

- North America (NA): $40.2 billion

- Europe (EUR):$ 27.7 billion

- Asia, Oceania, and Africa (AOA): $24.1 billion

- Latin America (LATAM): $15.8 billion

- Greater China (GC):$ 6.8 billion

Use This Effective Boycott Checklist

Are you considering organizing a boycott? These criteria can help you decide if your action will have an impact:

- Clear Goal – Is there a specific, achievable demand or change?

- Public Support – Do enough people understand and care about the issue?

- Economic Leverage – Will reducing purchases meaningfully impact the company?

- Alternative Options – Can participants easily switch to other products or services?

- Company Responsiveness – Is the company sensitive to public opinion or reputation?

- Sustained Participation – Can the boycott be maintained long enough to matter?

- Organized Strategy – Is there coordination and clear messaging?

- Visibility & Media – Will the boycott attract media, social media, or influencer attention?

- Measurable Impact – Can success be tracked (sales, policy change, public statements)?

- Ethical Foundation– Is the boycott framed ethically for credibility?

The lesson is clear: Not all boycotts pack the same punch. Target, Tesla, and Disney show that when consumers unite around a clear goal with enough leverage, change is possible. Amazon and Nestlé, meanwhile, remind us that size, diversified revenue, and limited alternatives can make even the loudest protest fall flat.

A boycott works best when it’s focused, strategic, and sustainable. We need to make smart, strategic choices to maximize our impact on companies that bend the knee to fascism.